Vehicle Registration Tax (VRT) is a significant cost when registering a car in Ireland, and in 2025, new rules make the process more focused on environmental impact. Many other countries are also encouraging the use of low-emission vehicles to reduce environmental pollution.

If you’re buying, importing, or registering a vehicle in Ireland this year, it’s important to understand how VRT works, how it’s calculated, and what factors can affect the final amount you pay. This guide will walk you through the entire VRT calculation process in plain language.

What is Vehicle Registration Tax (VRT)?

VRT stands for Vehicle Registration Tax. It’s a tax you must pay when registering a vehicle in Ireland for the first time. Whether you’re importing a used car from the UK or buying a new vehicle, You must pay VRT on it. To quickly find out how much, use a free VRT Calculator by REG.

Here below we mentioned some of the important steps which help you in calculating VRT manually in 2025.

1. Start with the OMSP (Open Market Selling Price)

This is the estimated market value of the car in Ireland. The Revenue Commissioners decide the OMSP based on vehicle details like make, model, mileage, year, and overall condition.

You can use an OMSP calculator to help determine the Open Market Selling Price in Ireland.”

2. Apply the CO₂-Based VRT Rate

In 2025, the main component of VRT is still based on CO₂ emissions. Here’s how it works:

- Lower CO₂ emissions = lower VRT rate (starting at 7%)

- Higher emissions = higher VRT rate (up to 41%)

- Rates are determined using the WLTP (Worldwide Harmonised Light Vehicle Test Procedure) standard

3. Add the NOx Levy

There’s also a charge for NOx (Nitrogen Oxide) emissions which you can also calculate with the help of NOx tax calculator. It makes you easy to get an estimate because when we do manual calculations it takes a lot of time and also the results are not accurate.

The more NOx your vehicle emits, the higher this additional tax. It’s calculated in euro per mg/km over a certain threshold, and it applies especially to older diesel engines.

4. Identify the Vehicle Category

VRT rates also differ depending on the type of vehicle:

- Category A: Passenger cars, based on CO₂ emissions

- Category B: Light commercial vehicles (e.g. vans), taxed at 8% if emissions are under 120g/km, or 13.3% above that

- Category C: Heavy commercial vehicles pay a flat rate of €200

- Category D: Exempt vehicles (e.g. ambulances, fire trucks)

5. Account for Electric and Hybrid Reliefs

To support clean energy, electric vehicles (EVs) registered before December 31, 2025, can get up to €5,000 in VRT relief. However:

- Full relief is only available if the vehicle’s OMSP is under €40,000

- Relief reduces between €40,000 and €50,000

- No relief if OMSP exceeds €50,000

If you want to calculate VRT on electric cars, check if the vehicle qualifies for the €5,000 relief available until the end of 2025. Make sure the car’s OMSP stays under €40,000 to get the full benefit, as the relief reduces above this limit.

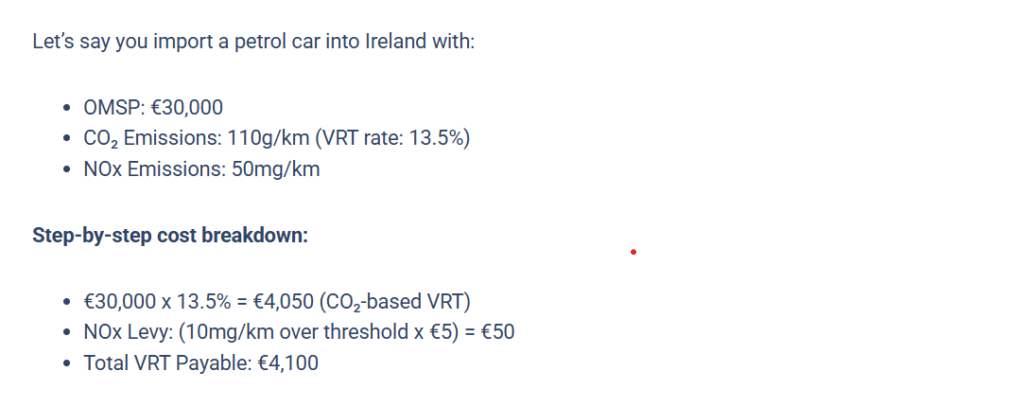

Real-World Example of VRT Calculation

When and Where to Pay VRT?

You must pay VRT within 30 days of bringing the vehicle into Ireland. You can calculate an estimate using the Revenue VRT calculator or register your vehicle at an NCTS (National Car Testing Service) centre. Payment is typically done online or at the time of registration.

Always check the updated VRT rates before registration, as they may differ from previous years.The rules and rates are different for each category vehicles. If you are importing a vehicle from other countries like UK, check other duties also. When you are importing a car from other countries you may pay the VAT and other custom duties on it.

Tips to Lower VRT in 2025

- Choose low-emission vehicles to get a lower tax rate.

- Consider EVs for significant relief.

- Use the official Revenue VRT calculator to avoid surprises.

- Be cautious with NOx-heavy diesel imports—these may result in a high levy.

Important FAQs:

Q: How do I calculate VRT?

A: To calculate VRT in 2025, multiply the car’s Open Market Selling Price (OMSP) by the VRT rate based on CO₂ emissions. Then, add the NOx levy if applicable.

Q: What is the road tax in Ireland 2025?

A: Road tax in Ireland 2025 is based on your vehicle’s CO₂ emissions. Electric cars pay the lowest, while high-emission vehicles pay more annually.

Q: Is the VRT calculator accurate?

A: Our VRT calculator is fully updated for 2025 and covers all vehicle types, including EVs and hybrids. It uses the latest Revenue rates and rules.

Q: How to get VRT statistical code?

A: You can find the VRT statistical code by entering your car’s make, model, and year in the official Revenue VRT calculator or using our tool.

Q: How do I enable VRT?

A: You don’t need to enable VRT. It’s charged automatically when registering an imported or new vehicle at an NCTS center in Ireland.

Q: How to calculate NOx?

A: To calculate NOx tax, find your vehicle’s NOx value in mg/km. Charges start after a set threshold and increase based on the amount over it.

Final Thoughts

Many VRT Calculator Ireland you find online are no longer working or don’t show the right results for 2025. Some don’t include all types of vehicles or miss important charges like NOx or discounts for electric cars. That’s why we made our own tool to calculate VRT.

It works for all kinds of vehicles like cars, vans, electric cars, and more. You’ll get a quick and easy estimate based on the latest rules. When you are reasy to pay the tax, there is two option the one is you can do to the motor tax office and the other is online form submission. The best way to pay VRT and registering a vehicle is online method through motor tax online website.